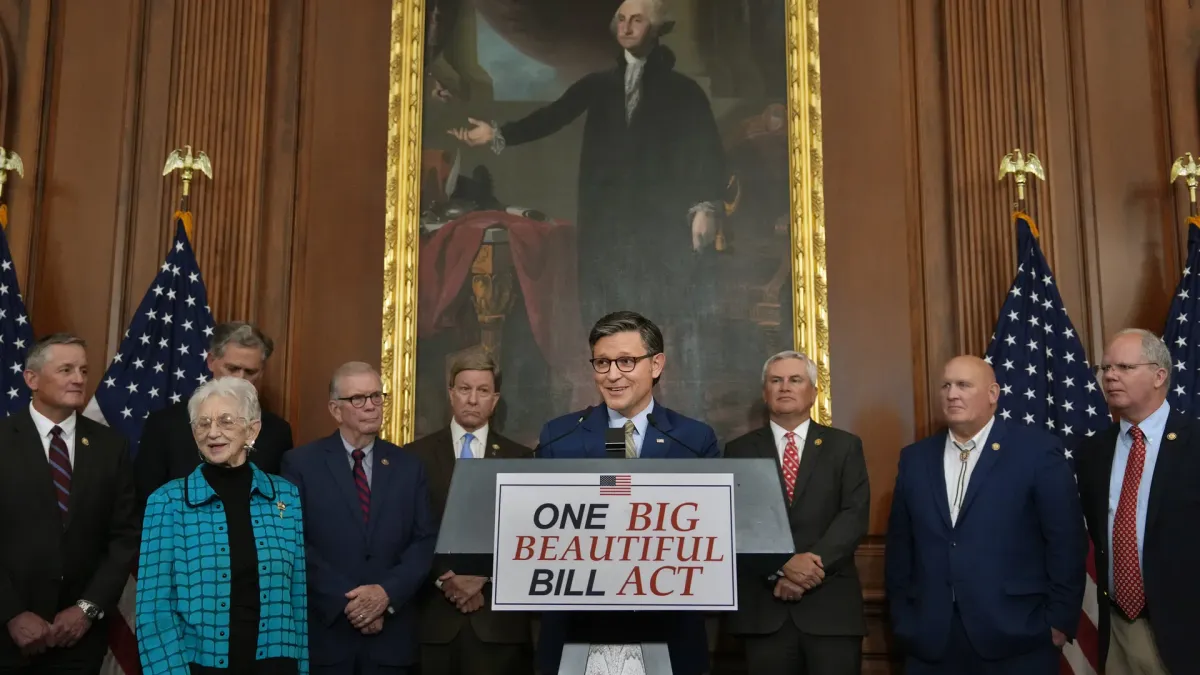

One Big Beautiful Bill 2025 - What Federal, Postal, and D.C. Employees Need to Know

The One Big Beautiful Bill Act of 2025 (OBBBA), passed in July 2025, reshapes healthcare, employment, and financial security for federal, postal (USPS), and D.C. employees. At FedGap, we offer Disability, Whole Life, and Critical Illness insurance exclusively for active federal, postal, and D.C. employees, designed to fill gaps in your benefits. Enroll while employed to secure coverage that stays with you, even if you leave your job. This article outlines the OBBBA, explains its impact on health and life insurance, and shows how FedGap’s tailored solutions keep you protected.

What Is the One Big Beautiful Bill?

The OBBBA is a sweeping legislative package addressing taxes, spending, healthcare, and federal employment. Here’s a quick overview:

- Tax Reforms: Extends 2017 tax cuts, lowering individual rates (e.g., top rate from 37% to 35%) and corporate taxes (21% to 20%), while eliminating deductions like state and local taxes (SALT). Adds $3.4 trillion to deficits over 10 years, per the Congressional Budget Office (CBO).

- Healthcare Changes: Tightens Medicaid eligibility with work requirements (80 hours/month starting December 2026) and cuts funding by $793 billion. Shortens ACA Marketplace enrollment and ends premium tax credits post-2025.

- Federal Workforce: Introduces “Schedule Policy/Career” (similar to Schedule F), making some jobs at-will, and offers new hires a choice between job security with higher pension contributions or at-will status with lower contributions. Targets 121,000 federal layoffs or buyouts.

- FEHB Protection: Includes the FEHB Protection Act, preserving Federal Employees Health Benefits (FEHB) and Postal Service Health Benefits (PSHB) structures.

- Other Provisions: Boosts defense spending, reforms energy project permitting, and adjusts Social Security for high earners.

Why It Matters: These changes could strain federal budgets, affect job stability, and alter healthcare access, impacting your benefits planning.

How OBBBA Affects Health and Life Insurance

The OBBBA’s healthcare and workforce reforms create new challenges for your insurance needs. Here’s what to expect:

Health Insurance Impacts

- Medicaid Restrictions: Work requirements and frequent eligibility checks (every six months) will lead to 11.8 million losing coverage by 2034, including 7.8 million from these rules, per the CBO. If your low-income dependents or retirees rely on Medicaid alongside FEHB or PSHB, expect higher costs for private plans. Disability protections are promised but may not prevent disruptions.

- ACA Marketplace Changes: A shorter enrollment period (ending December 15) and stricter verifications (income, immigration status) end auto-renewals. Expiring premium tax credits post-2025 could raise premiums, with 1.8 million more uninsured by 2034. Early retirees or those using Marketplace plans to supplement FEHB/PSHB will face increased costs.

- FEHB and PSHB:

- Federal and D.C. Employees (FEHB): Premiums rise 13.5% in 2025 due to healthcare cost trends, not OBBBA. The bill’s deficit increase may pressure future FEHB funding, potentially leading to higher premiums or fewer options.

- Postal Employees (PSHB): Starting January 1, 2025, 1.9 million USPS workers and retirees shift to PSHB, with a 6.9% premium increase. Most post-2024 retirees must enroll in Medicare Part B ($175-$350/month), raising total costs. Medicaid cuts could hit dual-enrolled retirees hardest.

What to Expect: Higher out-of-pocket costs for those losing Medicaid or ACA subsidies, especially retirees or families with low-income members. Postal employees face added Medicare costs, while FEHB users should prepare for future premium hikes.

Life Insurance Impacts

- FEGLI Stability: The OBBBA doesn’t alter the Federal Employees’ Group Life Insurance (FEGLI) program, so coverage remains intact for now.

- Job Insecurity Risks: The “Schedule Policy/Career” designation and potential layoffs (121,000 workers targeted) increase job risk. If you leave federal service, FEGLI ends, requiring a costly individual policy conversion.

- Retirement Planning: New pension options (job security vs. lower contributions) may prompt earlier retirements, necessitating portable life insurance to replace FEGLI.

What to Expect: Employees facing layoffs or retirement need to plan for life insurance continuity, as FEGLI’s limitations (no cash value, non-portable) become more critical amid OBBBA’s workforce shifts.

How FedGap Can Help

At FedGap, we offer insurance solutions exclusively for active federal, postal, and D.C. employees, ensuring you’re covered now and in the future - even if you leave your job. Enroll while employed to lock in our Disability, Whole Life, and Critical Illness plans, and let our agents connect you to health insurance options for broader needs.

Our Specialized Plans

- Disability Insurance: Protects your income if illness or injury prevents work. With OBBBA’s job cuts looming, our plans ensure financial stability, covering bills and expenses during recovery.

- Whole Life Insurance: Offers lifelong coverage with fixed premiums and cash value growth, unlike FEGLI, which ends upon leaving federal service. Ideal for employees planning retirement or facing job insecurity.

- Critical Illness Insurance: Pays lump sums for serious conditions (e.g., cancer, stroke), offsetting costs FEHB or PSHB don’t fully cover. Essential as healthcare expenses rise.

Health Insurance Connections

Facing Medicaid or ACA coverage losses? Concerned about FEHB/PSHB premium hikes or Medicare costs? FedGap’s expert agents can connect you to trusted health insurance solutions, ensuring affordable plans to bridge gaps.

Why FedGap?

Our team understands federal benefits inside out. We analyze your FEHB, PSHB, or FEGLI coverage to design plans that fit your life - whether you’re a postal worker navigating PSHB’s Medicare rules or a federal employee planning early retirement. With OBBBA shaking things up, now’s the time to enroll while you’re employed to secure coverage that lasts.

Next Steps for 2025

- Enroll Now: Contact a FedGap agent at FedGap.com to lock in Disability, Whole Life, or Critical Illness plans while you’re a federal, postal, or D.C. employee - coverage you can keep even if you leave.

- Navigate Open Enrollment: Use the 2024 Open Enrollment period to adjust FEHB/PSHB plans. Postal employees, verify Medicare Part B enrollment to avoid penalties.

- Address Health Gaps: If Medicaid or ACA changes affect you, let FedGap connect you to health insurance options tailored to your budget.

- Plan for Job Shifts: If layoffs or pension changes loom, our Whole Life and Disability plans offer peace of mind.

The OBBBA brings uncertainty, but FedGap brings clarity. Visit FedGap.com today to connect with an agent and build a benefits plan that stands strong in 2025 and beyond - but act now, as eligibility ends when your employment does.

Sources: Congressional Budget Office, Office of Personnel Management, Federal News Network